Student Loan Repayment Program Consultants

Saving on a Valuable Education (SAVE) Repayment Plan

Department of Education (ED) Updates on the Saving on a Valuable Education (SAVE Plan)

A Federal court issued an injunction preventing the U.S. Department of Education (ED) from implementing parts of the SAVE Plan and other IDR plans.

How It Affects Borrowers

Forbearance:

Borrowers enrolled in the SAVE plan have been moved into forbearance. During forbearance, SAVE borrowers will not have to make payments, and interest will not accrue on these loans, but the time in forbearance will not count toward Public Service Loan Forgiveness or Income-Driven Repayment (IDR) loan forgiveness. SAVE borrowers will be notified about their forbearance by their loan servicers.

Bills and payments:

Borrowers, and employers on borrowers’ behalf, can make a payment during this forbearance. That payment will be applied to future bills due after this forbearance ends. Borrowers who do not want to be in this forbearance can contact their servicer to change repayment plans. There will still be forbearance associated with changing to certain repayment plans.

Discretionary income exemption increases to 225% of FPL

Monthly payment amount is based on your discretionary income—defined as the difference between your adjusted gross income (AGI) and 225% of the Federal Poverty Line (FPL) for your family size. Under the previous REPAYE plan, the threshold was set at 150% of FPL.

Negative amortization eliminated

If a borrower’s scheduled monthly payment is less than the amount of accrued interest for the month, the additional interest is forgiven. That means loan balances won’t grow due to unpaid interest if you make your monthly payment.

Spousal income excluded from payment calculation

Borrowers who are married and file separately will longer have their spouse’s income included in the payment calculation amount.

This also removes the need for your spouse to cosign your IDR application.

How do I apply for the SAVE Plan?

If you are already enrolled in the REPAYE Plan or if you sign up for the REPAYE Plan today, you will automatically be put on the SAVE Plan. You can find more information on applying here.

When can I apply for the SAVE Plan?

If you apply for an IDR plan now and select the REPAYE Plan, you will automatically be put on the SAVE Plan once it becomes available. You can also select the option for your loan servicer to place you on the lowest monthly payment plan (this will usually be REPAYE).

The application for the new SAVE Plan is available on StudentAid.gov. You can also sign up by contacting your loan servicer directly.

What if I’m already on an IDR plan?

If you are already on an IDR plan, check to see if you are on the SAVE/REPAYE Plan. Log in to StudentAid.gov, go to your My Aid page, scroll down, and view your loans. Each loan will list a repayment plan. If you see that you are in the REPAYE Plan, that means you’ll automatically be enrolled in the SAVE Plan later this summer. If you’re on a different repayment plan, you’ll need to switch into the SAVE/REPAYE now to receive the benefits of the SAVE Plan. If you don’t have a StudentAid.gov account, you can create an account.

If you are already on an IDR plan, check to see if you are on the SAVE/REPAYE Plan. Log in to StudentAid.gov, go to your My Aid page, scroll down, and view your loans. Each loan will list a repayment plan. If you see that you are in the REPAYE Plan, that means you’ll automatically be enrolled in the SAVE Plan later this summer. If you’re on a different repayment plan, you’ll need to switch into the SAVE/REPAYE now to receive the benefits of the SAVE Plan. If you don’t have a StudentAid.gov account, you can create an account.

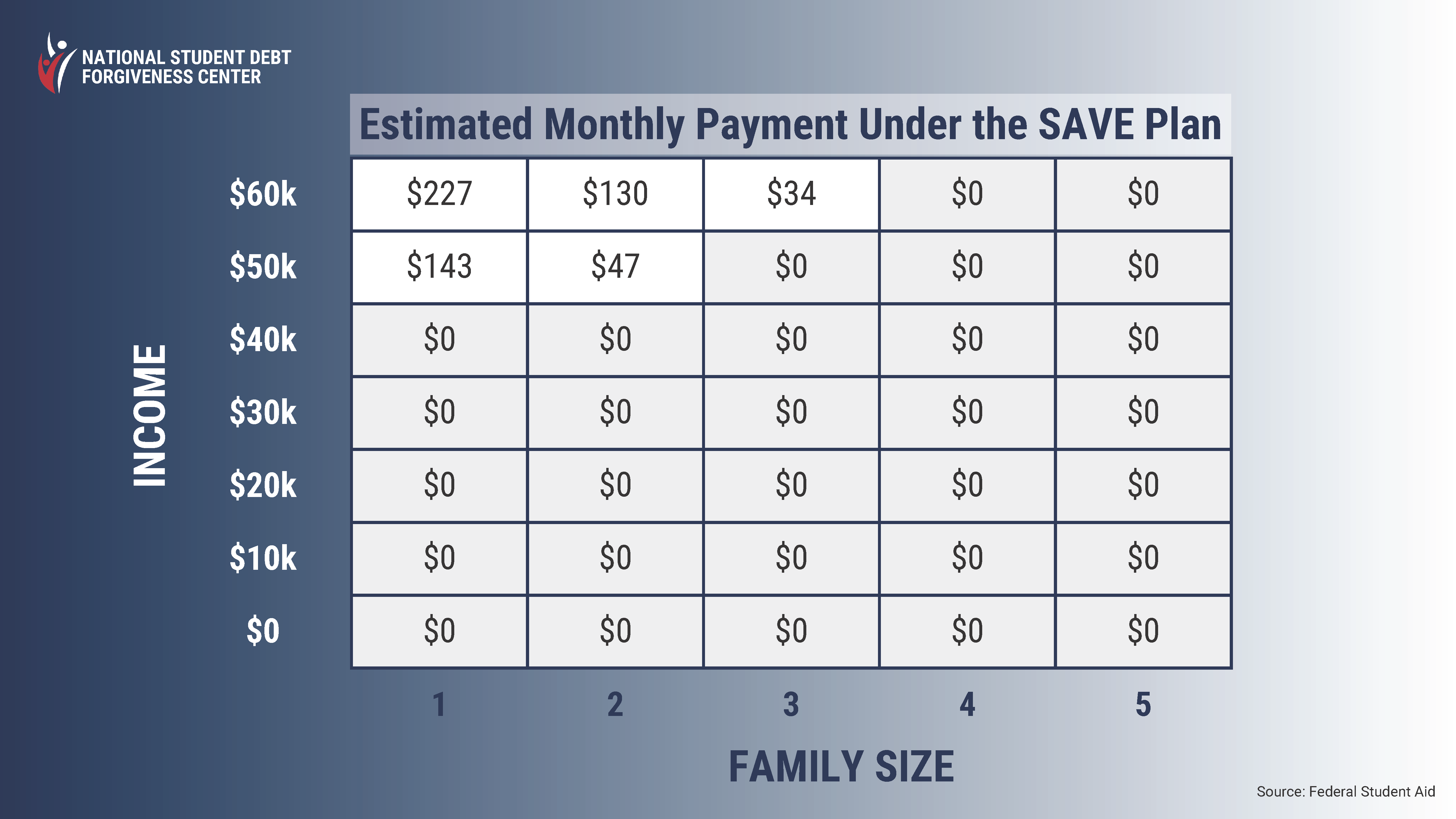

How much will I pay each month?

The SAVE Plan calculates your monthly payment amount based on your income and family size. If you’re making $32,800 a year or less (which is roughly $15 dollars an hour), your monthly payment will be $0. If you’re making more than that, you will save at least $1,000 a year, compared to other IDR plans.

Starting next summer, borrowers on the SAVE Plan will have their payments on undergraduate loans cut in half (reduced from 10% to 5% of income above 225% of the poverty line). Borrowers who have undergraduate and graduate loans will pay a weighted average of between 5% and 10% of their income based upon the original principal balances of their loans.

(For illustrative purposes only. Each case is different.)

How do I apply for the SAVE Plan?

If you are already enrolled in the REPAYE Plan or if you sign up for the REPAYE Plan, you will automatically be put on the SAVE Plan. The application is available by clicking here.

When can I apply for the SAVE Plan?

If you apply for an IDR plan now and select the REPAYE Plan, you will automatically be put on the SAVE Plan once it becomes available. You can also select the option for your loan servicer to place you on the lowest monthly payment plan (this will usually be REPAYE).

You can also sign up by contacting your loan servicer directly.

What if I’m already on an IDR plan?

If you are already on an IDR plan, check to see if you are on the REPAYE Plan. Log in to StudentAid.gov and go to your My Aid page, scroll down, and view your loans. Each loan will list a repayment plan.

If you see that you are in the REPAYE Plan, that means you’ll automatically be enrolled in the SAVE Plan later this summer. If you’re on a different repayment plan, you’ll need to switch into REPAYE now, or SAVE once it’s available, to receive the benefits of the SAVE Plan. If you don’t have a StudentAid.gov account, you can create an account.

What are the SAVE Plan benefits going into effect next year?

The SAVE Plan includes additional benefits that will go into effect in July 2024. These additional benefits are likely to reduce payments further and make it easier to manage repayment. The benefits include the following:

- Payments on undergraduate loans will be cut in half (reduced from 10% to 5% of income above 225% of the poverty line). Borrowers who have undergraduate and graduate loans will pay a weighted average of between 5% and 10% of their income based upon the original principal balances of their loans.

- Borrowers with original principal balances of $12,000 or less will receive forgiveness of any remaining balance after making 10 years of payments, with the maximum repayment period before forgiveness rising by one year for every additional $1,000 borrowed. For example: if your original principal balance is $14,000, you will see forgiveness after 12 years. Payments made previously (before 2024) and those made going forward will both count toward these maximum forgiveness timeframes.

- Borrowers who consolidate will not lose progress toward forgiveness. They will receive credit for a weighted average of payments that count toward forgiveness based upon the principal balance of the loans being consolidated.

- Borrowers will automatically receive credit toward forgiveness for certain periods of deferment and forbearance.

- Borrowers will be given the option to make additional “catch-up” payments to get credit for all other periods of deferment or forbearance.

- Borrowers who are 75 days late will be automatically enrolled in IDR if they have agreed to allow the Department of Education to securely access their tax information.

How can I qualify for a $0 monthly payment amount?

IDR plans protect a minimum amount of income to ensure you are able to cover basic necessities like food and housing costs. Since IDR plans are calculated based on income and family size, if your household income is below that level, you will have a $0 monthly payment. Each time you recertify your IDR plan with updated income and family size information, you may see your payment adjusted.

If you have a $0 payment due, you do not need to pay anything that month. Just make sure you know your recertification date so you don’t miss it. Then you’ll never miss your recertification date and won’t forget to re-certify your income annually.

Your monthly payment amount is based on your discretionary income—the difference between your adjusted gross income (AGI) and 225% of the Federal Poverty Line. If you are a single borrower earning $32,800 or less or a family of four earning $67,500 or less (amounts are higher in Alaska and Hawaii).

What happens if I apply for IDR after my servicer has already generated my first bill?

If you apply for the SAVE Plan close to your servicer’s bill issue date or before your required payment due date, your servicer will place you in a forbearance status for the upcoming billing cycle so that you do not pay more than you need to. Your servicer will also place you in forbearance if they cannot process your application before these dates. You can check your application status by logging onto your account with your student loan servicer.

What other changes to income-driven repayment are coming next summer?

New integration with the IRS to access financial information

Automatic IDR recertification of income and family size

End of interest capitalization when a borrower leaves most IDR plans

Redesigned application

Need help making sense of it all?

Click the button below to contact us and find out how to schedule an appointment. We look forward to hearing from you!

Select Page