Student Loan Repayment Program Consultants

CPTA Student Loan Counseling Program

Welcome, Carle Place Teachers’ Association!

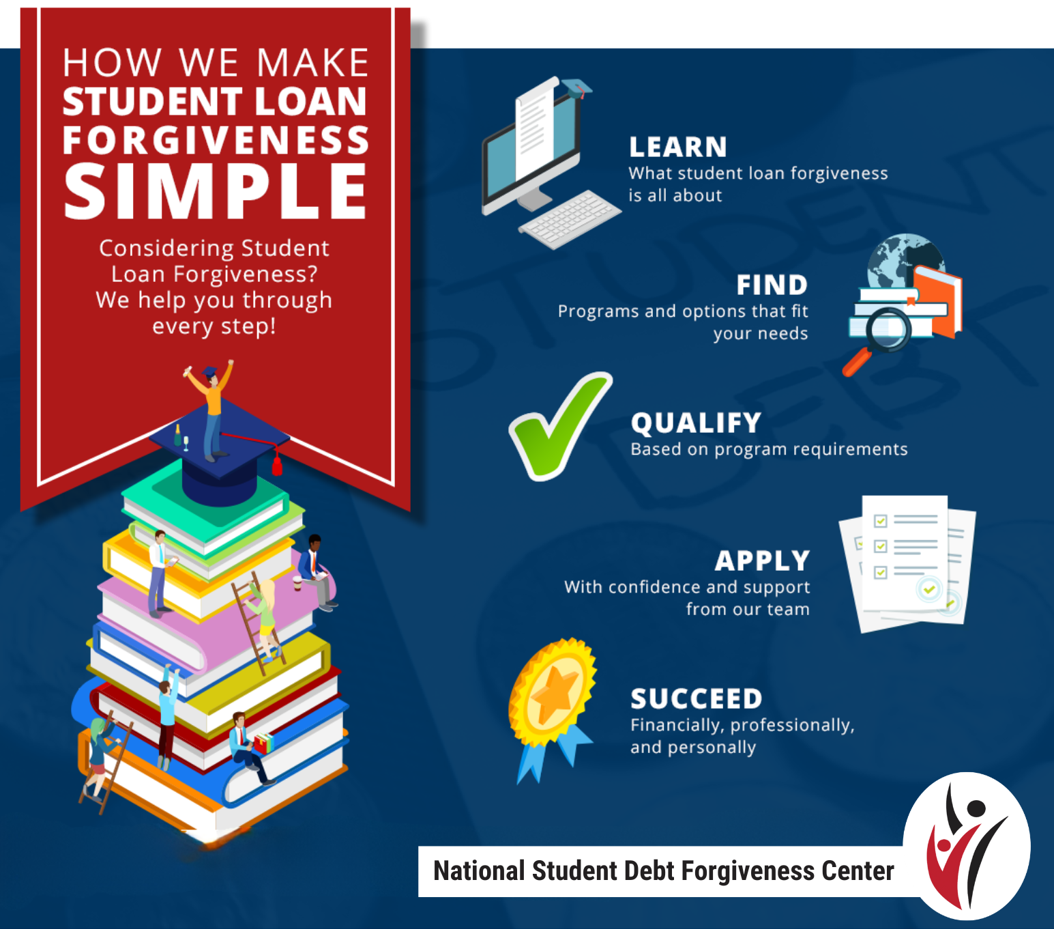

If you have federal student loans, you may be eligible for student loan forgiveness. National Student Debt Forgiveness Center’s student loan consultants will ensure you are paying off your student loan debt as efficiently as possible. They will also help determine if you are eligible for lower monthly payments, shortened loan terms, or even tax-free forgiveness of your federal student loan debt!

Did you know?

CPTA member spouses and children with federal student loan debt are also eligible for free student loan forgiveness counseling with NSDFC.

About Federal Student Loan Forgiveness Programs

Public Service Loan Forgiveness (PSLF) Program

The PSLF Program forgives the remaining balance on Direct Loans after making 120 qualifying monthly payments (10 years’ worth) under a qualifying repayment plan, while working full-time for a qualifying employer.

PSLF Eligibility Requirements

- be employed by a U.S. federal, state, local, or tribal government or qualifying not-for-profit organization (federal service includes U.S. military service);

- work full-time (30+ hours/week) for a qualifying employer;

- have Direct Loans (or consolidate other federal student loans into a Direct Loan);

- repay loans under an Income-Driven Repayment (IDR) plan or a 10-year Standard Repayment plan; and

- make a total of 120 qualifying monthly payments (needn’t be consecutive)

Teacher Loan Forgiveness (TLF) Program

Under the Teacher Loan Forgiveness (TLF) Program, borrowers who complete five consecutive years working full-time in a Title 1 school may be eligible for forgiveness of up to $17,500 on their Direct Loans.

TLF Eligibility Requirements

- Not have had an outstanding balance on Direct Loans or Federal Family Education Loan (FFEL) Program loans as of Oct. 1, 1998, or on the date that you obtained a Direct Loan or FFEL Program loan after Oct. 1, 1998.

- Work as a full-time, highly qualified teacher for five complete and consecutive academic years, at least one which must have been after the 1997–98 academic year.

- Work at an elementary school, secondary school, or educational service agency that serves low-income students (a “low-income school or educational service agency”).

- Loan(s) for which you are seeking forgiveness must have been made before the end of five academic years of qualifying teaching service.

Good to Know:

Borrowers can’t receive credit toward TLF and Public Service Loan Forgiveness (PSLF) for the same period of service. That means, if you seek and receive TLF, the five-year period of service that supported your eligibility will NOT count toward PSLF.

Register for a Webinar

Click on a date and time below to register for a webinar. Can’t make it? Sign up anyway and watch afterwards on-demand at your own convenience.

CPTA / NSDFC - Student Loan Forgiveness Simplified webinar

CPTA / NSDFC - Student Loan Forgiveness Simplified webinar

Schedule Your Free Consultation Now!

Click the button below to schedule an appointment for a free, comprehensive one-on-one consultation with one of our expert student loan advisors today!

Select Page