Student Loan Repayment Program Consultants

Teacher Loan Forgiveness

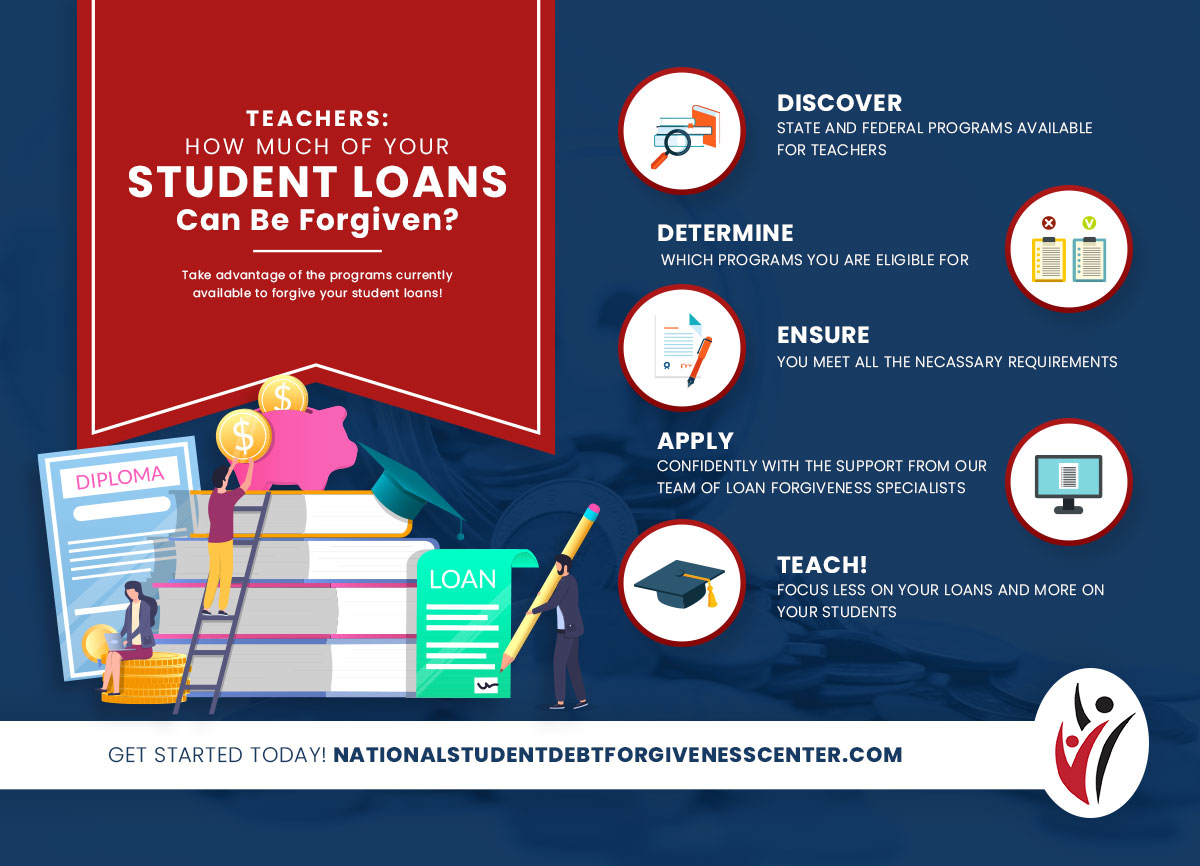

As a teacher, we don’t have to tell you that the pay is rarely equal to the work and is likely not even enough to pay off the student loans you had to take in order to become a teacher in the first place! Sadly, this leads many good, qualified teachers to leave the profession and look for more lucrative work. In an effort to keep good teachers in the classroom the federal government and even some state governments offer Teacher Loan Forgiveness to those who qualify.

WHAT IS TEACHER LOAN FORGIVENESS?

In a nutshell, teacher loan forgiveness is a program that allows certain teachers to earn forgiveness of their student loans in amounts of $5,000 or $17,500 (depending on qualifications) after five consecutive years of teaching in a qualified low-income school. Additionally, full loan forgiveness could possibly be available after another ten years. If you qualify for teacher loan forgiveness,, you could earn substantial, if not full loan forgiveness just by doing what you’re already doing. Talk with our loan forgiveness specialists to see if you qualify!

FORGIVENESS VS. DISCHARGE

It’s important to understand the distinction between the two ways in which a person may no longer be responsible for repayment of their student loans.

Discharge

Loan discharge occurs when certain drastic situations arise, making it impossible to repay the remainder of your loan-situations like death, permanent disability, your school closing before you complete your education, or certain kinds of bankruptcies, frauds, and disasters. In such cases, your circumstances may allow you to apply for a discharge, making the case in your application that your situation makes it impossible for you to repay the remainder of your loan.

Forgiveness

By contrast, loan forgiveness is a program meant to incentivize people to take jobs that may not offer high pay, or that involve service in low-income areas. Along with Perkins Loan Forgiveness and Public Service Loan Forgiveness, Teacher Loan Forgiveness falls into this category.

Note: Whether by discharge or by forgiveness, if you are freed from the obligation of repaying all or a portion of the remainder of your loan, the amount of money you have discharged or forgiven may be considered income and subject to federal tax.

The loan forgiveness specialists at the National Student Debt Forgiveness Center can help you determine which option could work for you, help you with the application process, and provide advice throughout the process.

If you Began Teaching Before October 30, 2004:

You could be eligible for up to $17,500 in loan forgiveness if you were:

- a highly-qualified teacher of math or science in an eligible secondary school; OR

- a highly-qualified special education teacher whose primary responsibility was providing special education for children with disabilities specifically corresponding to your areas of training, AND you have demonstrated knowledge and teaching skills in the areas of the curriculum that you taught.

You could be eligible for up to $5,000 in loan forgiveness if you were:

- a full-time teacher of reading, writing, math, or certain other subject areas in a qualified elementary school; OR

- a full-time secondary school teacher teaching in a subject related to your academic major.

As you read these qualifications for Teacher Loan Forgiveness, two terms keep popping up: “qualified low-income school” and “highly qualified teacher.” Since these two terms are key to your eligibility for loan forgiveness under this program, let’s have a closer look at what they mean.

HOW MUCH CAN BE FORGIVEN?

The amount of your loans that can be forgiven varies greatly upon your specific circumstances, but as a teacher you may be eligible for forgiveness of $5,000 or $17,500 of your qualified student loans. You may also qualify for Public Service Loan Forgiveness, a separate program that offers 100% of your remaining loan after an additional ten years of work. For now, let’s focus on the Teacher Loan Forgiveness Program and what makes the difference between eligibility for $5,000 and eligibility for $17,500 in loan forgiveness.

QUALIFIED LOW-INCOME SCHOOLS

This part is easy. Every year, the U.S. Department of Education publishes its Annual Directory of Designated Low-Income Schools for Teacher Cancellation Benefits. Simply visit the Low-Income School Directory at https://tcli.ed.gov and see if your school is on the list. If it is, you’re eligible; if it’s not, you’re not.

If your school is on the list, be sure that you enter the name of your school exactly as it appears on the list. Otherwise, your application will be rejected. Think of it like endorsing a check: You endorse a check exactly the way your name appears in the “Pay to the order of” section, otherwise the bank doesn’t know you are the person for whom the check was intended. The same is true with entering the name of your school in the application. If you don’t enter the schools name exactly as it appears in the Low-Income School Directory, then there’s no way to be sure you’re teaching in a school that has been designated for this purpose.

But what if your school was on the list during one of your five consecutive years of service, but not during the other four?

Don’t worry: As long as the school was listed in the Low-Income School Directory during your first year of teaching, your subsequent years of teaching in that school will count toward your eligibility, as well. NOTE that All elementary and secondary schools operated by the Bureau of Indian Education (BIE) or operated on Indian reservations by Indian tribal groups under contract with BIE qualify as schools serving low-income students. This remains true whether or not they were listed in the Low-Income School Directory.

HIGHLY-QUALIFIED TEACHERS

The other key factor impacting your eligibility for Teacher Loan Forgiveness is your status as a highly-qualified teacher. This status has a set of basic requirements for all teachers, and then specific requirements depending upon whether you are:

- an elementary or a secondary school teacher, or

- a new teacher.

Requirements for All Teachers:

To be considered highly qualified, all teachers must:

- hold a bachelor’s degree or higher;

- hold full state teacher certification; and

- not have had certification/licensing requirements waived for an emergency, provisional, or temporary basis.

Requirements for New Elementary School Teachers:

In addition to the requirements for all teachers, new elementary school teachers must pass a rigorous text to demonstrate subject knowledge and teaching skills in reading, writing, math, and other basic areas of the elementary school curriculum.

Requirements for New Middle School and Secondary School Teachers:

In addition to the requirements for all teachers, new middle school and secondary school teachers must demonstrate a high level of competency in each of the subject areas they teach, specifically by EITHER:

- passing a rigorous state academic subject test in each of those areas; OR

- completing an academic major, a graduate degree, the coursework equivalent to an undergraduate academic major, or an advanced certification or credential in each of the academic subjects in which they teach.

Requirements for Teachers Who Are Not New:

In addition to the requirements for all teachers, all teachers (whether in elementary, middle, or secondary school) must:

- meet all the requirements for a teacher who is new; and

- demonstrate competence in all the subjects in which he/she teaches, according to a uniform, objective standard of evaluation.

Whew! That’s a lot of information! Now that you know what constitutes a qualified low-income school and understand what is required to be considered a highly-qualified teacher, it’s simple: If you are a highly-qualified teacher who teaches in a qualified low-income school for five consecutive years, you are eligible for some amount of Teacher Loan Forgiveness.

But you must APPLY!

For help in determining your eligibility and your specific level of potential loan forgiveness, contact us today!

OTHER TYPES OF LOAN FORGIVENESS:

In addition to Teacher Loan Forgiveness, there are three other types of loan forgiveness for which you may also qualify: Perkins Loan Forgiveness, Public Service Loan Forgiveness, and State Loan Forgiveness for Teachers. Check out our articles on each of these topics.The following are examples of careers and organizations that qualify:

Wondering if you're Eligible?

Interested in setting up a no-obligation consultation?

Want to learn more? Get in contact with us by calling us or filling out the form below and one of our professionals will reach out to you. We look forward to hearing from you.

More Info

Address: 330 Motor Parkwy, Suite 308

Hauppauge, New York 11788

Phone: 888-384-0877

Email: info@nsdfcgroup.com

Select Page